IT Solutions For Insurance Industry

Transforming with Modern Tech Solutions

In today's fast-paced world, insurance companies need modern solutions to stay ahead of the competition and meet the evolving needs of their customers. Traditional practices that rely on manual processes are becoming increasingly obsolete, making it essential for insurers to embrace new technologies such as AI, IoT, and big data.

Key Insights

Insurance Transformation over of 5 years

The global IoT insurance market is expected to reach 2027

Insurance executives foresee industry transformation in 3 years.

Customers open to digital channels for insurance interactions.

Demand

Exploring the Importance of Technology in Modernizing Insurance Businesses.

Rising demand for Insurance services

Insurance companies face challenges in meeting changing customer expectations, competition, and cost pressures. Technology adoption, including AI, IoT, and big data, can streamline operations, improve risk assessment, and enhance customer experience, while reducing fraud and developing new products. Technology is essential for insurers to stay competitive in today’s rapidly evolving marketplace.

For Agencies Insurance Providers, Insurance Agents, Carrirers, Broker

Customer Relationship Management (CRM) software

Helps manage customer data, track interactions, and automate follow-up tasks.

Underwriting Software

Automates the underwriting process, reducing the time and cost required to evaluate risks and approve policies.

Policy Administration Software

Streamlines policy management, allowing insurers to create, modify, and issue policies more efficiently.

Claims Management Software

Helps manage the entire claims process, from initial filing to final settlement, reducing errors and improving customer satisfaction.

Billing and Payment Processing Software

Automates the billing process, making it easier for customers to make payments and for insurers to track payments.

Document Management Software

Helps manage documents and files, reducing the need for physical storage and improving access to important information.

Data Analytics Software

Helps insurers analyze large amounts of data to identify trends, assess risks, and make data-driven decisions

Fraud Detection Software

Uses AI and machine learning to identify fraudulent activities, helping insurers reduce losses and improve overall profitability.

Marketing automation software

Helps insurance companies target the right customers with the right products, reducing marketing costs and increasing customer acquisition.

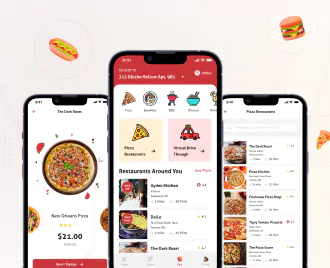

Mobile apps

Allow customers to access their policy information, file claims, and make payments on-the-go, improving the overall customer experience and satisfaction.

Developing effective strategies for Insurance organizations: Key focus areas to consider.

All important features to learn anywhere, anytime online

Increased Efficiency

Automating policy issuance, underwriting, and claims processing can boost insurance companies' efficiency and speed.

Enhance Customer Experience

Tech like mobile apps, portals, and chatbots can improve insurer-customer interactions and experience.

Better Risk Assessment

Data analytics tools can help insurers assess risks and identify trends for better underwriting decisions.

Competitive Advantage

Adopting new technologies and tools can help insurers remain relevant, competitive, and attract new customers.

Increase Cost Savings

Insurers can improve their bottom line and reduce operational costs by automating tasks and reducing manual labor.

Enhanced Security

Encryption and multi-factor authentication can help insurers protect customer data and prevent breaches.

WHY CHOOSE US?

Let IndiaNIC handle your healthcare IT requirements

Cost-effectiveness

Cost-effective solutions without compromising quality or expertise.

Quality

Proven track record delivering high-quality work, meeting deadlines, and providing the best solutions to clients.

Flexibility

We adapt to clients' changing needs to ensure our solutions meet their requirements.

Communication

Responsive communication and work closely with clients to understand their needs.

Security

We prioritize data privacy and use strong security measures to protect client data.

Expertise

Tech experts mastering regulations and standards, offering specialized solutions for all your needs.

FAQs

-

Life Technologies

-

Jackson Coker

-

McDonalds

-

Vodafone

-

Adidas

-

Oracle

-

MTN

-

MTU

-

BCG

-

Sancho BBDO

-

Smithfield

-

Best Buy

-

Essilor

-

Cosmopolitan

-

Abbott

-

UNSW

-

Daman

-

AstraZeneca

-

VFS Global

-

Haas

-

Tata

-

Yahoo

Schedule a Meeting with Our Experts

Share a brief about your project and get a guaranteed response within 24 hours.