IT Services for Financial Industry

Transforming with Modern Tech Solutions

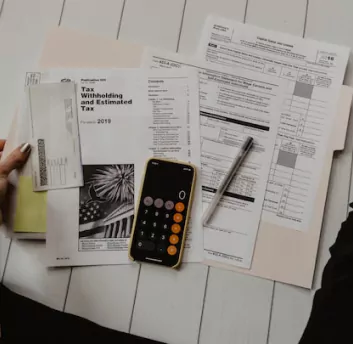

Modern technology has brought significant changes to the finance industry, transforming the way people manage money, invest, & conduct financial transactions. Mobile banking, algorithmic trading, and other financial technologies have revolutionized the industry, making financial services more accessible for individuals. These advances have led to a shift in the way people interact with financial institutions, paving the way for a more efficient & streamlined financial ecosystem.

Key Insights

Finance Industry Transformation over of 5 years

The global fintech market is expected to reach in 2025 by

of financial companies have been impacted by disruptive technologies like AI, Big Data, etc.

of consumers use mobile banking apps and and 45% prefer it over visiting a physical branch.

Significance of Finance Business to modernize their business with technology

For Banks, Investment firms, and Insurance companies.

Accounting software

This type of software can help streamline financial management processes, such as accounts payable and accounts receivable, by automating tasks and reducing errors.

Customer Relationship Management (CRM)

This type of software can help financial organizations manage customer relationships, track interactions, and identify new business opportunities.

Data analytics software

Financial organizations can use this type of software to analyze large amounts of data and gain insights into market trends, customer behavior, and investment performance.

Risk management software

Financial organizations can use this type of software to assess and manage risk, such as credit risk and market risk, and ensure compliance with regulations.

Investment management software

Investment firms, pension funds, and other financial organizations can use this type of software to manage portfolios, track performance, and identify new investment opportunities.

Trading software

Stock exchanges and investment firms can use this type of software to facilitate trading activities, such as order routing and execution.

Financial planning software

Financial advisors can use this type of software to develop personalized financial plans for clients, including retirement planning, tax planning, and estate planning.

Compliance management software

Financial organizations can use this type of software to ensure compliance with regulations, such as the Dodd-Frank Act and the Sarbanes-Oxley Act.

Document management software

Financial organizations can use this type of software to manage and organize important documents, such as contracts, legal agreements, and client records.

Workflow automation software

Financial organizations can use this type of software to automate repetitive tasks and streamline processes, such as onboarding new clients and processing loan applications.

Developing effective strategies for Finance organizations Key focus areas to consider.

All important features to learn anywhere, anytime online

Increased Efficiency

Software solutions automate tasks and streamline processes, helping organizations complete them faster with fewer errors.

Improved Accuracy

Software solutions reduce errors and increase accuracy, crucial in finance where mistakes can have serious consequences.

Improved Decision-Making

Software solutions offer real-time data and analytics, improving decision-making and identifying opportunities for organizations.

Enhance Customer Experience

Software solutions improve customer experiences, enabling faster response times and personalized services.

Better Data Management

Software solutions manage large data sets effectively, ensuring easy accessibility and up-to-date information.

Reduced Costs

Software solutions improve efficiency, reduce errors, save time and money, and increase profitability for organizations.

WHY CHOOSE US?

Let IndiaNIC handle your finance technology outsourcing needs

Cost-effectiveness

Cost-effective solutions without compromising quality or expertise.

Quality

Proven track record delivering high-quality work, meeting deadlines, and providing the best solutions to clients.

Flexibility

We adapt to clients' changing needs to ensure our solutions meet their requirements.

Communication

Responsive communication and work closely with clients to understand their needs.

Security

We prioritize data privacy and use strong security measures to protect client data.

Expertise

Tech experts mastering regulations and standards, offering specialized solutions for all your needs.

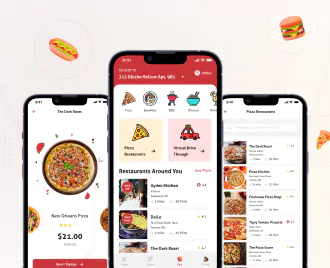

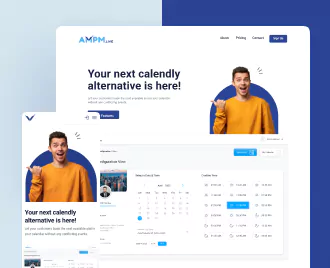

Take a closer look at our projects for the Finance industry

FAQs on IT Services for finance Industry

-

Life Technologies

-

Jackson Coker

-

McDonalds

-

Vodafone

-

Adidas

-

Oracle

-

MTN

-

MTU

-

BCG

-

Sancho BBDO

-

Smithfield

-

Best Buy

-

Essilor

-

Cosmopolitan

-

Abbott

-

UNSW

-

Daman

-

AstraZeneca

-

VFS Global

-

Haas

-

Tata

-

Yahoo

Schedule a Meeting with Our Experts

Share a brief about your project and get a guaranteed response within 24 hours.